Introduction: A New Era for Activewear Manufacturing

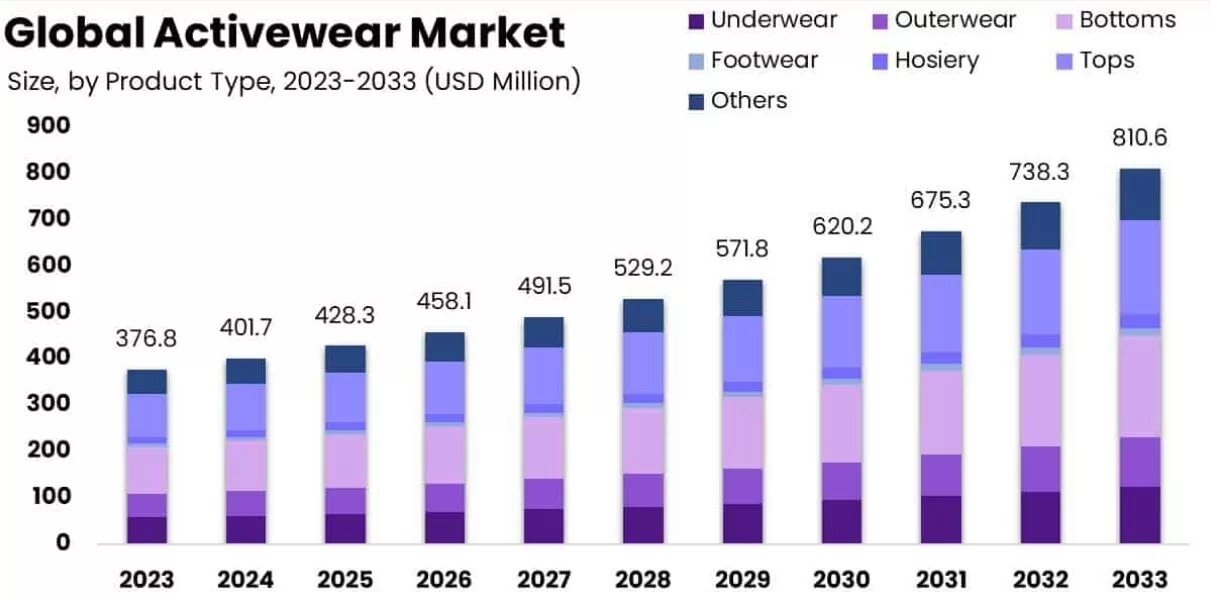

The activewear industry has exploded over the past decade. Driven by a global push for wellness, fashion-forward gym wear, and rising interest in sustainable clothing, the category has become a cornerstone of modern wardrobes. But behind the sleek silhouettes and performance fabrics lies a complex global supply chain—one that has recently been shaken by international politics.

Since 2018, the trade war between the United States and China has introduced a new financial burden on brands through tariffs—taxes applied to imported goods. This has had significant consequences on everything from material sourcing and product pricing to innovation and long-term manufacturing strategies.

In this blog, we’ll break down exactly how U.S.–China tariffs have impacted the activewear industry—and how companies like Bokamoda are helping brands stay agile, competitive, and profitable in this new era of apparel production.

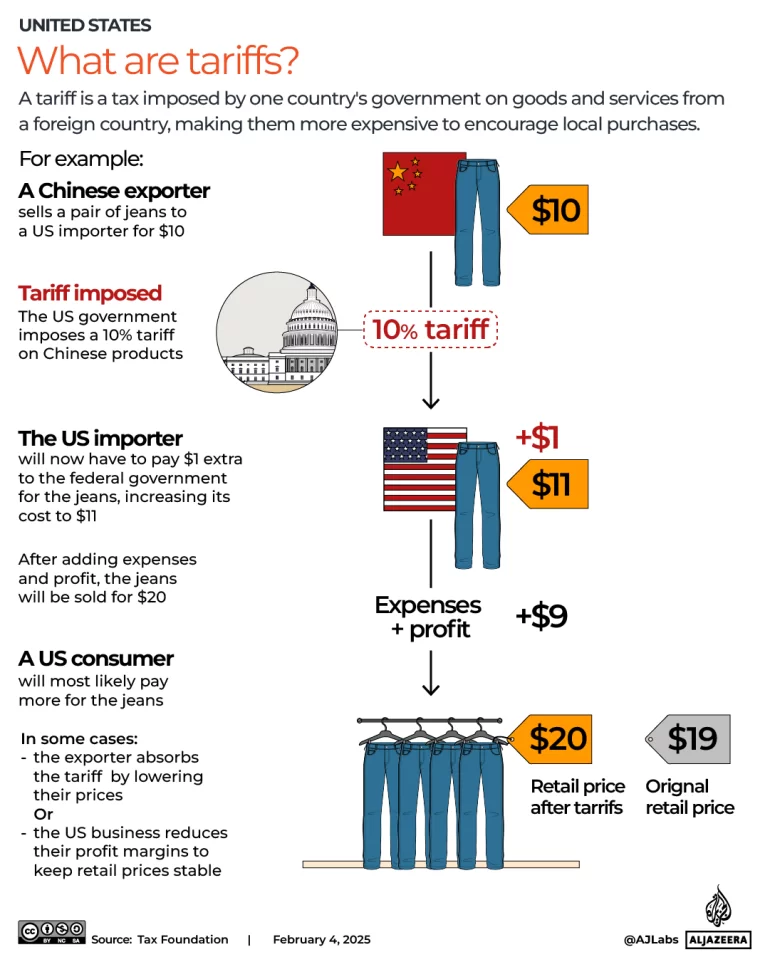

What Are Tariffs, and Why Do They Affect Activewear?

Tariffs are taxes placed by one country on imports from another. The idea is to protect domestic industries by making foreign goods more expensive. Beginning in 2018, the U.S. government imposed tariffs on hundreds of Chinese-made goods, including:

- Apparel and activewear

- Performance fabrics and textiles

- Footwear and sneakers

- Raw materials like elastic, polyester blends, and technical yarns

For example, many activewear categories were hit with tariffs ranging from 10% to 25%, including:

- Stretch leggings made of synthetic materials

- Mesh, seamless, and moisture-wicking garments

- Shoes and sport-specific gear

For activewear brands—especially startups or boutique labels relying on Chinese suppliers—this instantly raised costs and complicated long-standing sourcing strategies.

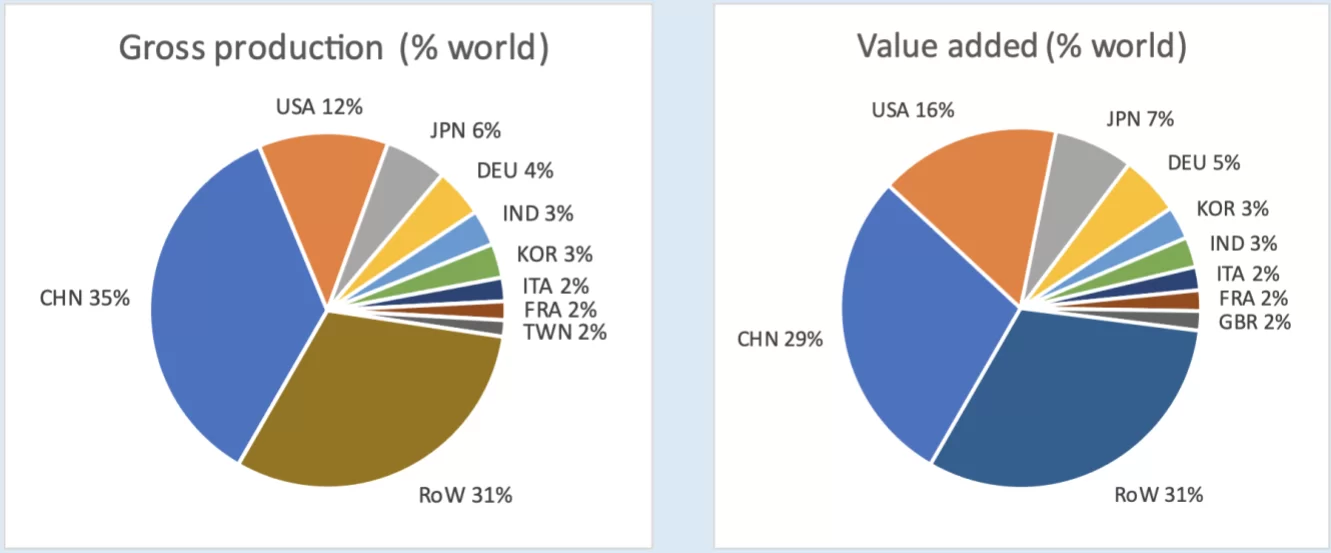

China’s Role as a Manufacturing Giant

For decades, China has been the backbone of the global apparel industry, offering:

- Advanced infrastructure and production capacity

- Expertise in technical fabrics

- Established supplier networks

- Cost-effective labor and logistics

Before tariffs, over 40% of all U.S.-imported clothing came from China. In activewear specifically, many high-performance fabric mills and assembly lines were based in Guangdong, Zhejiang, and Jiangsu provinces.

For brands, this meant fast turnaround times, consistent quality, and access to cutting-edge textiles. But when tariffs hit, everything changed.

The Financial Impact: Tariffs Raise the Cost of Doing Business

Imagine this: your brand orders $100,000 worth of leggings from a Chinese supplier. With a 25% tariff, that shipment now costs $125,000—before shipping, warehousing, or customs fees.

Multiply this across thousands of units, and the financial burden becomes staggering, especially for:

- Emerging brands with limited budgets

- Retailers operating on tight margins

- E-commerce brands competing in saturated online marketplaces

Brands Faced Three Options:

- Absorb the cost and reduce profitability.

- Raise prices, risking customer pushback.

- Change suppliers—a costly, time-consuming pivot.

Many chose a mix of all three.

The Hidden Toll: Innovation, R&D, and Sustainability

The activewear industry thrives on innovation. But tariffs have redirected budgets from product development to logistics and cost management. Many brands delayed or canceled:

- Development of eco-friendly fabrics like recycled PET or bamboo blends

- Upgrades to seamless technology or bonding machines

- Performance testing and lab certifications

Even sustainability initiatives have taken a hit, as sourcing from ethical suppliers in non-tariff regions may come with higher costs.

At Bokamoda, we continue to invest in:

- Sustainable sourcing solutions

- Cutting-edge design and prototyping

- Private label services that empower our clients to launch confidently

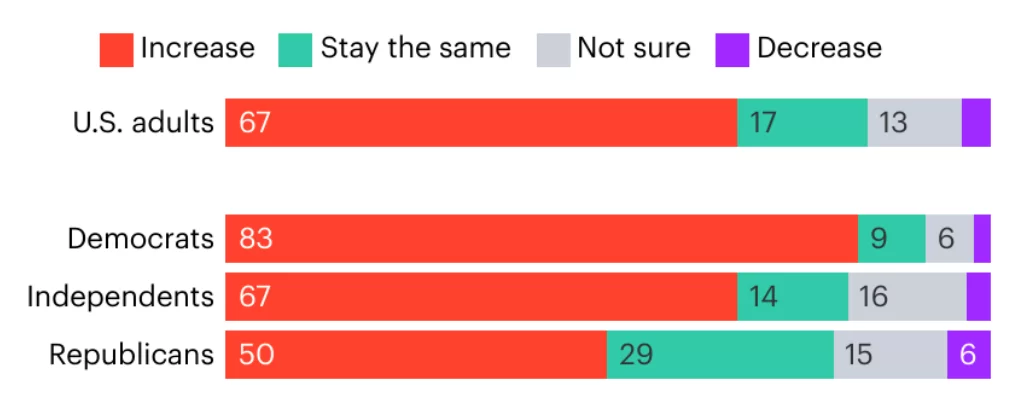

How Consumers Are Affected

While consumers don’t directly see the word “tariff” on price tags, the impact is real:

- Higher retail prices for leggings, sports bras, and outerwear

- Reduced discounts or bundle deals

- Lower stock availability or delayed product launches

Consumer behavior is also shifting:

- Demand for longer-lasting, high-quality garments is rising

- More customers are choosing domestic or transparent brands

- Shoppers are paying attention to where products are made

Bokamoda’s Role in the Post-Tariff Supply Chain

As a custom wholesale activewear manufacturer, Bokamoda understands how complex this landscape has become. That’s why we offer:

- Low MOQs for flexibility

- Private label services for brand identity

- Production in trusted non-tariff countries

- Support in design, tech packs, sampling, and logistics

We are not just a factory—we’re a long-term partner for activewear brands seeking growth in a competitive, globalized world.

📸 Suggested Image: Bokamoda factory team, fabric rolls, or close-up of sewing/seamless production in progress.

Final Thoughts: The Road Ahead for Activewear

The tariff-fueled trade war between the U.S. and China was a wake-up call for the global fashion industry. It exposed over-dependence on one country and forced innovation in sourcing, logistics, and strategy.

For brands today, success depends on supply chain flexibility, regional diversification, and cost-smart manufacturing—all things Bokamoda specializes in.

If your brand is looking for a reliable, scalable, and future-ready manufacturing partner, we’re here to help.